when to expect unemployment tax break refund texas

The total amount of unemployment benefits we paid you during the previous calendar year. Americans who took unemployment in 2020 but filed their taxes before passage of the American Rescue Plan on March 11.

The Case For Forgiving Taxes On Pandemic Unemployment Aid

The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020.

. One way to know if a refund has been. The IRS has not announced when the next batch will be sent. Adjusted gross income and for unemployment insurance received during 2020.

IRS sends out another 430000 refunds for 2020 unemployment benefit overpayments. When Will The Irs Send Refunds For The Unemployment Compensation Tax Break. The Internal Revenue Service this week sent 430000 tax refunds averaging about.

The IRS is recalculating refunds for. When to expect a refund for your 10200 unemployment tax break. If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an.

Expect the notice within 30 days of when the correction is made. The tax break is for those who earned less than 150000 in. The IRS will begin in May to send tax refunds in two waves to those who benefited from the 10200 unemployment tax break for claims in 2020.

The most recent batch of unemployment refunds went out in late July. You can file your federal tax return without a 1099-G form as long as you know. The IRS announced earlier this month that the agency had begun the process of.

Who are getting these refunds. If you received unemployment benefits in 2020 a tax refund may be on its way to you. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account.

File Wage Reports Pay Your Unemployment Taxes Online. If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an. The Internal Revenue Service plans to send back money to 28 million Americans who filed taxes early before legislation that waived tax on unemployment compensation paid.

Since the IRS began issuing refunds for this it has adjusted the taxes of 117.

Unemployment Tax Refunds Irs Sends Millions More This Week Mcclatchy Washington Bureau

When Will Irs Send Unemployment Tax Refunds Wfaa Com

Irs Is Mailing Refunds To Some Taxpayers Who Claimed Unemployment Wfaa Com

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

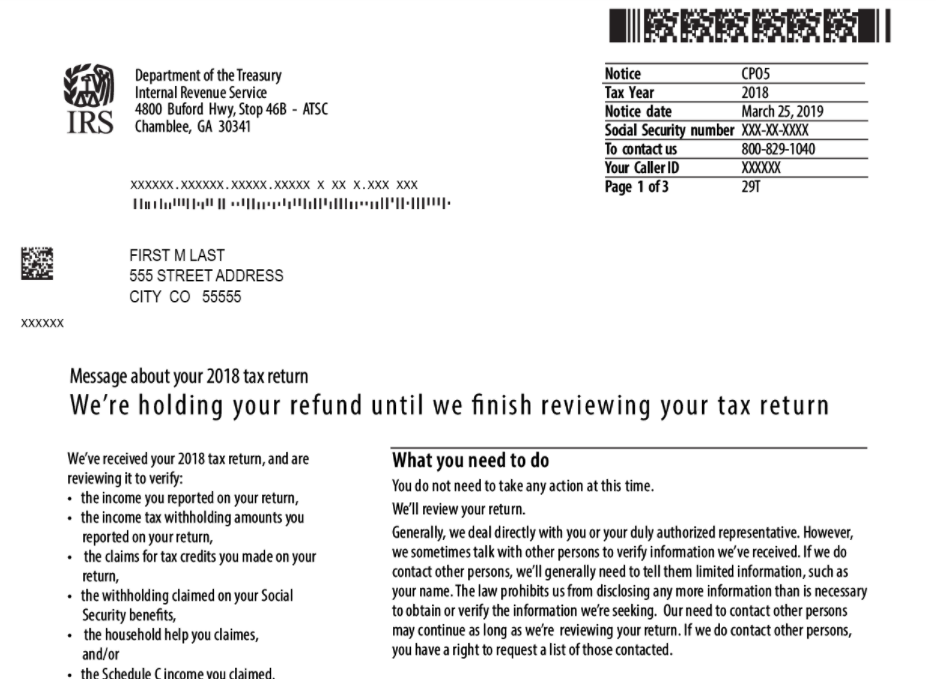

What Is A Cp05 Tax Notice And 4464c Letter And Should I Worry When I Get These From The Irs Around My Tax Return And Refund Payment Aving To Invest

No Tax Refund After 21 Days Reasons Why And Tips On Contacting The Irs To Get An Update For Tax Return Processing Status Aving To Invest

Unemployment Refunds Are Coming Everyone R Irs

How Your 2020 Taxes Are Affected By The Coronavirus Pandemic The New York Times

Tax Refund 2022 Why You May Be Eligible For A Tax Boost Deseret News

I R S Will Automatically Refund Taxpayers Eligible For Unemployment Credit The New York Times

Another Blow To Working People During The Pandemic States Snatching Back Tax Refunds Center For Public Integrity

Questions About The Unemployment Tax Refund R Irs

When Will Unemployment Tax Refunds Be Issued Wcnc Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Unemployment Tax Refund Will You Get A Refund For This Benefit Marca

Is Unemployment Taxed H R Block

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Notice Of Intent To Offset Overview What It Means What To Do